Oak Springs was a small insurance brokerage in Salem, Oregon which specialized in equine (horse) insurance.

Overview

There are very few equine insurance agents in the Western US, so this brokerage had a large, very niche target market.

The Owner/Agent contracted me through a temp agency to fill in as office manager for 3 months. Once there, the owner asked if I could help with marketing on top of my regular duties, but with no marketing budget and no time allocated in my schedule for marketing activities.

The Goal

The owner stated that she simply wanted to sell more policies.

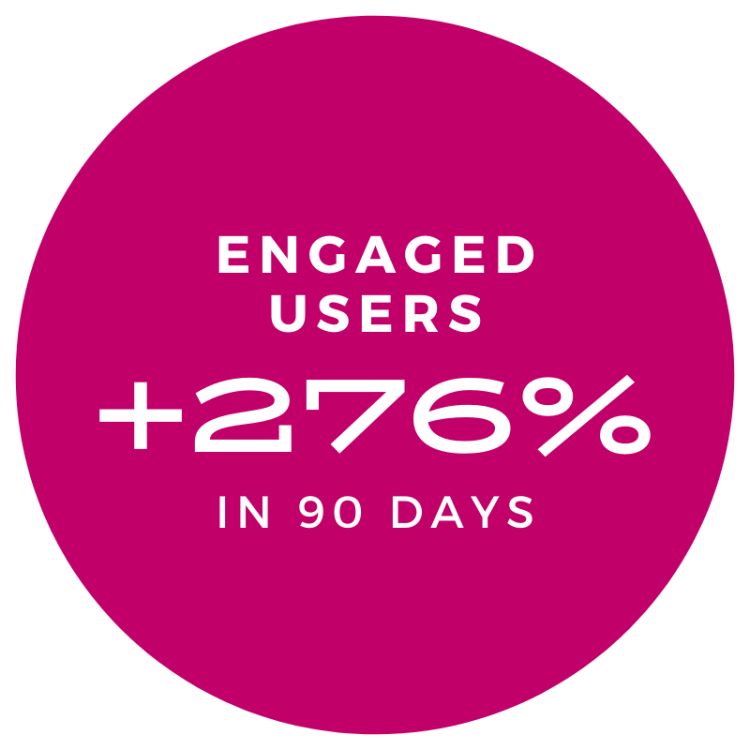

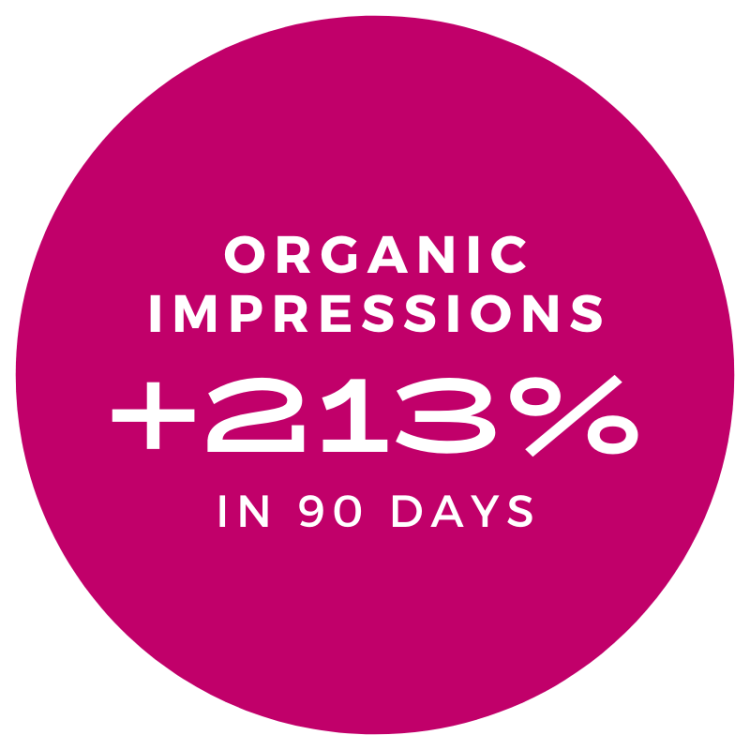

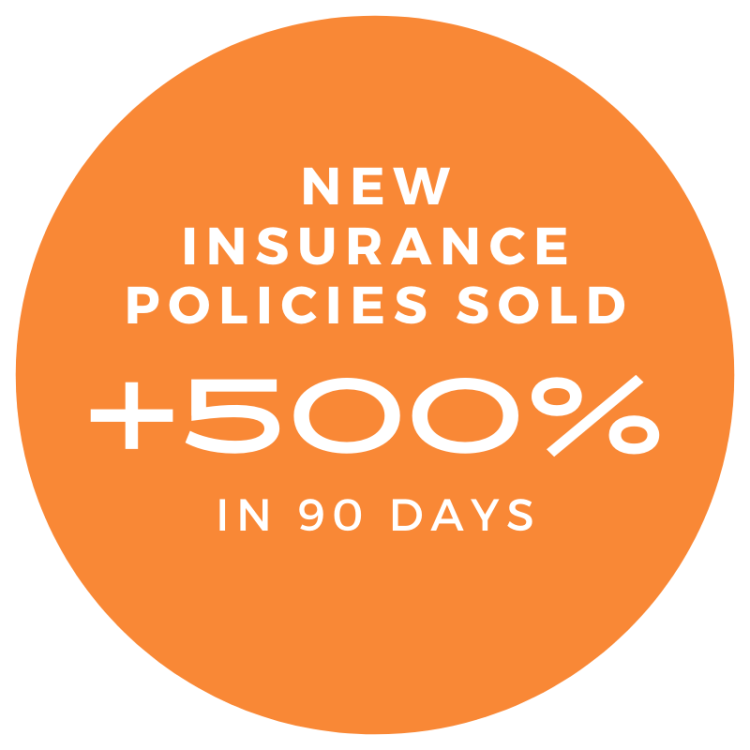

Results within 90 days:

Website

- Repaired hacked and corrupted WordPress website

- Upgraded website security

- Added Google Analytics to the website

- Cleaned up website navigation

- Unpublished blank and/or unnecessary pages from the website

- Claimed the agency on Yelp and Google My Business

- Corrected the agency’s location on Google maps and Bing maps

Social Media & Inbound Marketing

- Conducted the agency’s 3rd Annual Photo contest, crowdsourcing original horse-themed images for publication in the following year’s calendar

- Updated the agency’s Facebook header image with a call to action and contact info (shown above.) The fonts, colors, and branding matched existing print collateral and signage.

- Developed a content calendar for blog and Facebook posts which included informational, humorous, inspirational, and helpful equine-themed content. About 25% of Facebook content supported the topic of that month’s blog post.

- Researched the most frequent types of insurance claims this agency sees, then focused on publishing helpful information to prevent these kinds of losses

(I knew nothing about horses at the time) - Wrote a long-form blog post about equine and barn safety as my pillar content, then broke it into a year’s worth of individual blog posts with related social media posts

- Scheduled blog posts to auto-publish to the blog each month, and automatically share to Facebook, for the following year

- Scheduled Facebook posts to auto-publish daily for the following six months

Direct Mail Campaign

- Ran a highly targeted direct mail campaign to horse owners in the Pacific Northwest

- Wrote two lead-generating phone scripts – one for cold calls and the other for contacting warm leads

- Built a database of prospective customers

- Updated the agency’s letterhead to match existing collateral

- Drafted sales letter

- Set up MS Word mail merge to produce 75 semi-customized letters that were mailed to sales prospects

- When this campaign was complete, I advised the owner to run a similar direct mail campaign to existing customers, as she was about to become a state agent endorsed by Cover Oregon, the state administration of the Affordable Care Act (Obamacare.) I reasoned with her that many existing equine customers were horse ranches and stables, a type of small business that would be legally required to seek out some form of health insurance.

In addition to the above, I documented all of my work, especially the direct mail process, to help streamline any future marketing efforts done at the agency.

Skills used

- Business Communication

- Leadership

- Critical Analysis

- Persuasion

- Office management

- Organizational skills

- Project management

- Coaching

- Creativity

- Content writing

- Web design

- HTML

- Social Media/Facebook

- Google My Business

- HootSuite + Buffer

- WordPress + Plugins

- MS Word

- MS Excel

- Phone sales

Case Study

When my brief tenure began at Oak Springs Insurance, my schedule was full with managing the office, fielding phone calls, and learning the various policy quoting systems in use. While working on these tasks, I mentally worked out my next marketing steps so when I had a free moment I was ready to get to work. I completed many of my marketing tasks while on hold on the phone, when covering coworker lunch breaks, and in the mornings before the office became busy.

Challenges

This was an intense job, with limited support from the owner. She had been in business for approximately 8 years and was very reluctant to change her marketing processes to achieve a different outcome.

In addition, the agency was a very small office with limited technology in use. All record-keeping was done with paper files, and there was no CRM or accounting software, so all marketing research was performed by hand.

Understanding that recommending some marketing strategies would be a tough sell, I opted to focus on fixing existing problems and then conducting activities that she and her staff could replicate after I left. Ultimately, I was able to do a few things that produced quantifiable results fairly quickly.

On my first day there, I was tasked with conducting the agency’s 3rd annual photo contest, which was to begin that week. This contest was the agency’s primary marketing activity, where people shared photos of their horses via Facebook to enter the contest, then all the photos were presented together and page visitors voted on their favorite. The top 12 images were published in a wall calendar for the following year. These calendars were given away as a premium to existing customers in December.

While working on the photo contest, I leveraged the increase in Facebook traffic to begin posting a curated mix of useful, humorous, and interesting equine-related content. Several posts were shared multiple times, resulting in a significant increase in impressions on those posts, followed by an overall increase in page likes.

For the first time ever, the agency began receiving requests for quotes via Facebook Messenger.

Initial Results & Momentum

This initial marketing effort gave us positive, measurable results. From here, I analyzed our best-performing Facebook posts to create a content calendar, while planning the remainder of my marketing plan.

This also helped to reassure the owner that we were on the right path. At this point, she was willing to consider my next recommendations.

Research

I began with an examination of the agency’s current marketing strategy, followed by research. I noted the size of the target market in states where the owner is licensed to sell, then analyzed the number of quotes requested against the sales close rate.

During this time, I asked how she came to sell equine insurance, as it’s an uncommon line of insurance to sell. She explained that she had always been an insurance agent selling home, auto, and life insurance, but when they purchased their horse, they had a very difficult time finding coverage for him. Other horse owners she knew had also expressed difficulty in covering their animals as well. She immediately saw a need for a local equine agent, so she decided to specialize in this insurance line.

From here, I realized we could sell more policies in two different ways:

- Cross-sell home and auto insurance lines to customers who currently only have equine insurance with her

- Drive awareness among horse, stable, and ranch owners that she sells the insurance they need. This would be done with a combination of both push and pull marketing strategies.

Cross-Selling

Selling additional lines to existing customers would produce measurable results fairly quickly, so I began there, building a database of customers and types of policies sold. Once I identified equine policyholders who did not also have their home and auto with us, I recommended the owner schedule meetings with these clients to conduct a policy review. A policy review looks over current coverage, compares it with current needs, then recommends additional coverage to cover any gaps in protection. During the policy review, I advised her to offer competitive quotes to try and consolidate all policies under a single agent.

We also looked at cross-selling health insurance under Obamacare, as that program was just being rolled out. I’ll explain how we incorporated this into our sales mix when I discuss the direct mail campaign.

Driving Awareness

Upon hearing how difficult it was to find equine insurance, I did some research to see what was currently available. At that time, only three other agencies in the entire US were licensed to sell these specialty policies in Oregon and Washington, and one only offered limited coverage. I saw a huge opportunity here.

Knowing I only had a brief period in which to work, it made sense to incorporate both push and pull marketing with our target market. I began with pull marketing so it could work on autopilot while I focused on my push strategy.

SEO & Inbound Marketing

Understanding the agent’s reluctance to try anything new, I began working on a pull strategy, incorporating SEO optimization on each page of the website, planning keyword-optimized blog posts, and developing a social media content calendar.

The goal was to make it easier for horse owners to find her agency when searching for any type of equine insurance.

I feel it is important to note that I am not a horse person. While I was familiar with insurance, I knew nothing about horses. Before producing any content, I needed to educate myself about the hobby and industry so I could write from a position of authority.

This needed to be a “set it and forget it” strategy, as I knew the permanent staff at the agency would not create any new blog or social media content after I left. To make this process as simple as possible for staff, I wrote and scheduled 12 months of blog posts to appear on the company website.

Following that, I built a large database of (stock) images and text in a spreadsheet so they could be uploaded to Hootsuite (social media scheduling software) in bulk a few times each year. This database contained about 18 months of daily content, including special holiday posts, with recommended posting dates.

Last, I created illustrated step-by-step instructions on how to bulk schedule these posts, with instructions to recycle the database to continue posting past the 18-month mark. I know recycling old content is not a marketing best practice, but this was the best fitting solution I could come up with, given the circumstances.

Direct Mail

Once I had the pull marketing on autopilot, I then focused on a push marketing approach, which was accomplished through a direct mail campaign, supported by phone prospecting.

The goal of this campaign was to set appointments.

This campaign coincided with the passing of the Affordable Care Act (Obamacare.) The agent had recently been approved by the state to be endorsed to sell health insurance policies for Care Oregon, which administers Obamacare at the state level. The Care Oregon website didn’t work well, and the application process was tedious and confusing.

As you may remember, when Obamacare began, health insurance coverage was mandatory, which led to quite a bit of pushback from small business owners concerned about cost. I suggested to the agent that in addition to selling equine policies, we should also offer to help our prospects (and existing clients) navigate the difficult application process.

To prepare for the campaign, I wrote two phone scripts – one for cold-calling and the other for contacting existing clients. I also composed a mail-merge letter that would be mailed out to sales prospects and current clients. This letter included a call to action to meet with our agent.

Next, I compiled a database of all the horse people I could find in Oregon and Washington: individual owners, competition and event organizers, stables, boarding, trainers, schools, ranches, nonprofits, etc. Our database had about 200 contacts on it at this point.

From there, I called each contact and using one of the two scripts, I qualified them as leads who may be interested in learning more about how we could help them.

At this point, we now had a list of 75 warm leads for our direct mail campaign. Letters were mailed out near the end of my time at the agency, so I wrote instructions for the agent to make follow-up calls to each of these leads with the goal of setting an appointment.

I was never able to learn the outcome of this strategy, but we had a lot of excitement in-house regarding this campaign, and quite a bit of momentum going in this direction.

Lessons Learned

While challenging, this was a fun project. I had the opportunity to produce marketing results with no budget, I practiced my own sales skills when persuading the agent to try some new approaches, and I saw success in training others how to perform some simple marketing tasks.

I am still kicking myself for not taking more screenshots of the work I produced. I did, however, download all of the Facebook analytics data, which is where I got the results numbers shown above.

Would I do something like this again? Absolutely!

I would jump at the chance to have another opportunity to develop and incorporate a variety of marketing strategies for another small business. I’d do that in a heartbeat. This is what I want to do when I grow up.

While I disliked setting up all of this wonderful work only to walk away with hopes that it will survive on its own, I understood that this is the way it is with some small businesses. Whenever possible, I would rather complete a project with the expectation that I would reach out from time to time to review their situation to see if the current strategy was working or if it needed to be adjusted. I believe this would be the best way to serve my own clients.

Oak Springs Insurance has since merged with another agency. The website, blog, and Facebook pages that I worked on have all been deleted.